Global Coconut Sugar Market Outlook

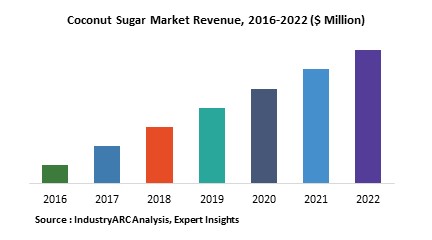

According to WHO, worldwide obesity has nearly tripled since 1975. Additionally, in 2016, more than 1.9 billion adults were overweight out of which over 650 million were obese. Now, this has become a major concern in the world which majorly attributes to the consumption of sugar that is responsible for raising insulin levels, subsequently leading to obesity. While the aforementioned data is disquieting, it’s a flourishing factor leading to the coconut sugar market growth that already had a global market size of $1.2 billion to $1.7 billion as of 2018 according to IndustryARC’s business intelligence report. Furthermore, the analyst projects that the coconut sugar market will grow at a remarkable CAGR of 5% to 6% during the forecast period of 2019-2025.

Coconut sugar is a healthy sugar produced from the sap of the flower bud stem of the coconut palm. It is also known as coconut palm sugar, coco sugar, coco sap sugar, or coconut blossom sugar. Coconut sugar is healthier than the common refined sugar as it has a low glycemic index, better electrolytes, and less fructose which causes multiple health issues. Due to this advantage, it is replacing refined sugar, leading to a constant rise in the global coconut sugar market revenue.

Coconut Sugar Market Trends – Disruption and an Analysis of Driving Factors Influencing the Market

Health Concerns Coupled with Awareness Widening the Coconut Sugar Marketplace –

According to a periodic survey by WHO, the number of people with diabetes was 108 million in 1980, and the figure catapulted to 422 million in 2014. Furthermore, the total number of deaths caused by diabetes in 2016 was 1.6 million, and the agonizing figure highly attributes to the consumption of refined sugar which has a high glycemic index. Moreover, cardiovascular diseases are number 1 cause of deaths in the world that had caused 17.9 million deaths in 2016, according to a 2017 report by WHO.

Now, the easily accessible Internet across the globe is creating health awareness among a remarkable fraction of the population. As larger masses become aware of the ill-effects of processed white sugar, increasing number of them are opting for healthier products, which is stroking the coconut sugar market by many-folds.

Even though coconut sugar is more expensive than the refined one, the people belonging to elite strata of society are willing to spend on it for a healthier life. So, the coconut sugar market is gaining grounds in developed and some parts of developing countries.

The coconut sugar has maximum application in food and beverages sector as it is used in bakery products, confectionary, food seasoning, juices, and tea. According to the estimations by the IndustryARC’s analyst, the application CAGR will be 5% to 6% in the sector.

Anti-aging Quality of Coconut Sugar: A Broad Spectrum of Target Market

Coconut sugar has amino acids which play an important role in the production of collagen within the skin which makes it an excellent anti-aging ingredient. Now, according to the predictions by the United Nations, the global population of people over 60 years of age was 962 million in 2017. Furthermore, the organization predicts that the population will be double in 2050 as compared to that in 2015. This means that a horde of people will face issues regarding their skins that attributes to aging during the forecast period of 2019-2025. The companies producing coconut sugar will be leveraging this and also the fact that the proliferating urbanization has led to a growth of disposable income. So, people around 40-50 years of age are more likely to use coconut sugar as a skincare product.

Coconut Sugar Market Share – A Regional Analysis

The leading region in the production will be APAC with a coconut sugar market share of 85%-90%. This chiefly attributes to the prevalence of coconut trees in many APAC countries such as India, Indonesia, and the Philippines to name a few. Even though there was a concern raised by Food and Agricultural Organization in 2013 about the aging of coconut trees in APAC, prompt actions were taken to rehabilitate the sector so that each of these countries keeps producing the usual figure of over 15 billion coconuts per year.

On the other hand, the demand for coconut products including coco sugar is rising in the European countries, especially in the food and beverages sector. This is mainly because the region is moving towards organic food products. So, coconut sugar market is also expected to witness growth in Europe.

Leading Players in the Coconut Sugar Market Leveraging the Demand –

Some of the market leaders in coconut sugar manufacturing are Cook Organic Foods LLP, Activa Enterprises Ventures Inc., and American Key Food Products. These key players are leveraging the demand for organic food in the U.S. and European countries.

Barry Callebaut which is the world’s leading manufacturer of chocolate and cocoa products is using coconut sugar to revive its organic chocolate sales. The company made the move to make their chocolate healthier and grab the attention of target customers by including coconut sugar which says volumes about the demand for the same.

The health issues pertaining to obesity and cardiovascular diseases are growing day by day. Moreover, the world is inclining towards organic food such as coconut sugar. The growing population of middle-aged and old people that are prospective customers of coconut sugar for skincare and consistent growth of disposable income has become the influencing factors of the thriving coconut sugar market. This is significantly backed by the consistent production of coconuts in the APAC region in the coming years; and so, it is discernible that coconut sugar market will be booming during the forecast period of 2019-2025.

1. Coconut Sugar Market – Overview

2. Executive Summary

3. Market Landscape

3.1. Market Share Analysis

3.2. Comparative Analysis

3.3. Product Benchmarking

3.4. End User Profiling

3.5. Top 5 Financials Analysis

4. Coconut Sugar Market– Forces

4.1. Drivers

4.1.1. Growing popularity amongst health conscious people due to its vitamins and other mineral contents

4.1.2. Growing demand for herbal skin care and hair care products

4.2. Restraints

4.3. Opportunities

4.3.1. Increasing demand in developing nations

4.4. Challenges

4.5. Porter’s Five Forces Analysis

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Power of Buyers

4.5.3. Threat of New Entrants

4.5.4. Threat of Substitutes

4.5.5. Degree of Competition

5. Coconut Sugar Market – Strategic Analysis

5.1. Value Chain Analysis

5.2. Pricing Analysis

5.3. Opportunities Analysis

5.4. Product/Market Life cycle Analysis

5.5. Suppliers & Distributors

6. Coconut Sugar Market, By Nutrient

6.1. Minerals

6.1.1. Potassium

6.1.2. Calcium

6.1.3. Iron

6.1.4. Zinc

6.1.5. Phosphorus

6.2. Vitamin C

6.3. Phytonutrients

6.3.1. Flavonoids

6.3.2. Antioxidants

6.3.3. Polyphenols

6.3.4. Anthocyanidin

7. Coconut Sugar Market, By Application

7.1. Baking

7.2. Confectionery

7.3. Tea

7.4. Juice

7.5. Food Seasoner

7.6. Others

8. Coconut Sugar Market, By Geography

8.1. Europe

8.1.1. Germany

8.1.2. France

8.1.3. Italy

8.1.4. Spain

8.1.5. Russia

8.1.6. U.K.

8.1.7. Rest of Europe

8.2. Asia Pacific

8.2.1. China

8.2.2. India

8.2.3. Japan

8.2.4. South Korea

8.2.5. Rest of Asia-Pacific

8.3. North America

8.3.1. U.S.

8.3.2. Canada

8.3.3. Mexico

8.4. Rest of the World (RoW)

8.4.1. Middle East

8.4.2. South America

8.4.3. Africa

9. Coconut Sugar – Market Entropy

9.1. Expansion

9.2. Technological Developments

9.3. Merger & Acquisitions, and Joint Ventures

9.4. Supply- Contract

10. Company Profiles (Overview, Financials, SWOT Analysis, Developments, Product Portfolio)

10.1. Company 1

10.2. Company 2

10.3. Company 3

10.4. Company 4

10.5. Company 5

10.6. Company 6

10.7. Company 7

10.8. Company 8

10.9. Company 9

10.10. Company 10

*More than 10 Companies are profiled in this Research Report*

"*Financials would be provided on a best efforts basis for private companies"

11. Appendix

11.1. Abbreviations

11.2. Sources

11.3. Research Methodology

11.4. Bibiliography

11.5. Compilation of Expert Insights

11.6. Disclaimer

List of Tables

Table 1: Coconut Sugar Market Overview 2019-2024

Table 2: Coconut Sugar Market Leader Analysis 2018-2019 (US$)

Table 3: Coconut Sugar Market Product Analysis 2018-2019 (US$)

Table 4: Coconut Sugar Market End User Analysis 2018-2019 (US$)

Table 5: Coconut Sugar Market Patent Analysis 2013-2018* (US$)

Table 6: Coconut Sugar Market Financial Analysis 2018-2019 (US$)

Table 7: Coconut Sugar Market Driver Analysis 2018-2019 (US$)

Table 8: Coconut Sugar Market Challenges Analysis 2018-2019 (US$)

Table 9: Coconut Sugar Market Constraint Analysis 2018-2019 (US$)

Table 10: Coconut Sugar Market Supplier Bargaining Power Analysis 2018-2019 (US$)

Table 11: Coconut Sugar Market Buyer Bargaining Power Analysis 2018-2019 (US$)

Table 12: Coconut Sugar Market Threat of Substitutes Analysis 2018-2019 (US$)

Table 13: Coconut Sugar Market Threat of New Entrants Analysis 2018-2019 (US$)

Table 14: Coconut Sugar Market Degree of Competition Analysis 2018-2019 (US$)

Table 15: Coconut Sugar Market Value Chain Analysis 2018-2019 (US$)

Table 16: Coconut Sugar Market Pricing Analysis 2019-2024 (US$)

Table 17: Coconut Sugar Market Opportunities Analysis 2019-2024 (US$)

Table 18: Coconut Sugar Market Product Life Cycle Analysis 2019-2024 (US$)

Table 19: Coconut Sugar Market Supplier Analysis 2018-2019 (US$)

Table 20: Coconut Sugar Market Distributor Analysis 2018-2019 (US$)

Table 21: Coconut Sugar Market Trend Analysis 2018-2019 (US$)

Table 22: Coconut Sugar Market Size 2018 (US$)

Table 23: Coconut Sugar Market Forecast Analysis 2019-2024 (US$)

Table 24: Coconut Sugar Market Sales Forecast Analysis 2019-2024 (Units)

Table 25: Coconut Sugar Market, Revenue & Volume,By Application, 2019-2024 ($)

Table 26: Coconut Sugar Market By Application, Revenue & Volume,By Baking, 2019-2024 ($)

Table 27: Coconut Sugar Market By Application, Revenue & Volume,By Confectionery, 2019-2024 ($)

Table 28: Coconut Sugar Market By Application, Revenue & Volume,By Tea, 2019-2024 ($)

Table 29: Coconut Sugar Market By Application, Revenue & Volume,By Juice, 2019-2024 ($)

Table 30: Coconut Sugar Market By Application, Revenue & Volume,By Food Seasoner, 2019-2024 ($)

Table 31: North America Coconut Sugar Market, Revenue & Volume,By Application, 2019-2024 ($)

Table 32: South america Coconut Sugar Market, Revenue & Volume,By Application, 2019-2024 ($)

Table 33: Europe Coconut Sugar Market, Revenue & Volume,By Application, 2019-2024 ($)

Table 34: APAC Coconut Sugar Market, Revenue & Volume,By Application, 2019-2024 ($)

Table 35: Middle East & Africa Coconut Sugar Market, Revenue & Volume,By Application, 2019-2024 ($)

Table 36: Russia Coconut Sugar Market, Revenue & Volume,By Application, 2019-2024 ($)

Table 37: Israel Coconut Sugar Market, Revenue & Volume,By Application, 2019-2024 ($)

Table 38: Top Companies 2018 (US$)Coconut Sugar Market, Revenue & Volume

Table 39: Product Launch 2018-2019Coconut Sugar Market, Revenue & Volume

Table 40: Mergers & Acquistions 2018-2019Coconut Sugar Market, Revenue & Volume

List of Figures

Figure 1: Overview of Coconut Sugar Market 2019-2024

Figure 2: Market Share Analysis for Coconut Sugar Market 2018 (US$)

Figure 3: Product Comparison in Coconut Sugar Market 2018-2019 (US$)

Figure 4: End User Profile for Coconut Sugar Market 2018-2019 (US$)

Figure 5: Patent Application and Grant in Coconut Sugar Market 2013-2018* (US$)

Figure 6: Top 5 Companies Financial Analysis in Coconut Sugar Market 2018-2019 (US$)

Figure 7: Market Entry Strategy in Coconut Sugar Market 2018-2019

Figure 8: Ecosystem Analysis in Coconut Sugar Market 2018

Figure 9: Average Selling Price in Coconut Sugar Market 2019-2024

Figure 10: Top Opportunites in Coconut Sugar Market 2018-2019

Figure 11: Market Life Cycle Analysis in Coconut Sugar Market Market Life Cycle Analysis in 3D Printing

Figure 12: GlobalBy ApplicationCoconut Sugar Market Revenue, 2019-2024 ($)

Figure 13: Global Coconut Sugar Market - By Geography

Figure 14: Global Coconut Sugar Market Value & Volume, By Geography, 2019-2024 ($)

Figure 15: Global Coconut Sugar Market CAGR, By Geography, 2019-2024 (%)

Figure 16: North America Coconut Sugar Market Value & Volume, 2019-2024 ($)

Figure 17: US Coconut Sugar Market Value & Volume, 2019-2024 ($)

Figure 18: US GDP and Population, 2018-2019 ($)

Figure 19: US GDP – Composition of 2018, By Sector of Origin

Figure 20: US Export and Import Value & Volume, 2018-2019 ($)

Figure 21: Canada Coconut Sugar Market Value & Volume, 2019-2024 ($)

Figure 22: Canada GDP and Population, 2018-2019 ($)

Figure 23: Canada GDP – Composition of 2018, By Sector of Origin

Figure 24: Canada Export and Import Value & Volume, 2018-2019 ($)

Figure 25: Mexico Coconut Sugar Market Value & Volume, 2019-2024 ($)

Figure 26: Mexico GDP and Population, 2018-2019 ($)

Figure 27: Mexico GDP – Composition of 2018, By Sector of Origin

Figure 28: Mexico Export and Import Value & Volume, 2018-2019 ($)

Figure 29: South America Coconut Sugar Market South America 3D Printing Market Value & Volume, 2019-2024 ($)

Figure 30: Brazil Coconut Sugar Market Value & Volume, 2019-2024 ($)

Figure 31: Brazil GDP and Population, 2018-2019 ($)

Figure 32: Brazil GDP – Composition of 2018, By Sector of Origin

Figure 33: Brazil Export and Import Value & Volume, 2018-2019 ($)

Figure 34: Venezuela Coconut Sugar Market Value & Volume, 2019-2024 ($)

Figure 35: Venezuela GDP and Population, 2018-2019 ($)

Figure 36: Venezuela GDP – Composition of 2018, By Sector of Origin

Figure 37: Venezuela Export and Import Value & Volume, 2018-2019 ($)

Figure 38: Argentina Coconut Sugar Market Value & Volume, 2019-2024 ($)

Figure 39: Argentina GDP and Population, 2018-2019 ($)

Figure 40: Argentina GDP – Composition of 2018, By Sector of Origin

Figure 41: Argentina Export and Import Value & Volume, 2018-2019 ($)

Figure 42: Ecuador Coconut Sugar Market Value & Volume, 2019-2024 ($)

Figure 43: Ecuador GDP and Population, 2018-2019 ($)

Figure 44: Ecuador GDP – Composition of 2018, By Sector of Origin

Figure 45: Ecuador Export and Import Value & Volume, 2018-2019 ($)

Figure 46: Peru Coconut Sugar Market Value & Volume, 2019-2024 ($)

Figure 47: Peru GDP and Population, 2018-2019 ($)

Figure 48: Peru GDP – Composition of 2018, By Sector of Origin

Figure 49: Peru Export and Import Value & Volume, 2018-2019 ($)

Figure 50: Colombia Coconut Sugar Market Value & Volume, 2019-2024 ($)

Figure 51: Colombia GDP and Population, 2018-2019 ($)

Figure 52: Colombia GDP – Composition of 2018, By Sector of Origin

Figure 53: Colombia Export and Import Value & Volume, 2018-2019 ($)

Figure 54: Costa Rica Coconut Sugar Market Costa Rica 3D Printing Market Value & Volume, 2019-2024 ($)

Figure 55: Costa Rica GDP and Population, 2018-2019 ($)

Figure 56: Costa Rica GDP – Composition of 2018, By Sector of Origin

Figure 57: Costa Rica Export and Import Value & Volume, 2018-2019 ($)

Figure 58: Europe Coconut Sugar Market Value & Volume, 2019-2024 ($)

Figure 59: U.K Coconut Sugar Market Value & Volume, 2019-2024 ($)

Figure 60: U.K GDP and Population, 2018-2019 ($)

Figure 61: U.K GDP – Composition of 2018, By Sector of Origin

Figure 62: U.K Export and Import Value & Volume, 2018-2019 ($)

Figure 63: Germany Coconut Sugar Market Value & Volume, 2019-2024 ($)

Figure 64: Germany GDP and Population, 2018-2019 ($)

Figure 65: Germany GDP – Composition of 2018, By Sector of Origin

Figure 66: Germany Export and Import Value & Volume, 2018-2019 ($)

Figure 67: Italy Coconut Sugar Market Value & Volume, 2019-2024 ($)

Figure 68: Italy GDP and Population, 2018-2019 ($)

Figure 69: Italy GDP – Composition of 2018, By Sector of Origin

Figure 70: Italy Export and Import Value & Volume, 2018-2019 ($)

Figure 71: France Coconut Sugar Market Value & Volume, 2019-2024 ($)

Figure 72: France GDP and Population, 2018-2019 ($)

Figure 73: France GDP – Composition of 2018, By Sector of Origin

Figure 74: France Export and Import Value & Volume, 2018-2019 ($)

Figure 75: Netherlands Coconut Sugar Market Value & Volume, 2019-2024 ($)

Figure 76: Netherlands GDP and Population, 2018-2019 ($)

Figure 77: Netherlands GDP – Composition of 2018, By Sector of Origin

Figure 78: Netherlands Export and Import Value & Volume, 2018-2019 ($)

Figure 79: Belgium Coconut Sugar Market Value & Volume, 2019-2024 ($)

Figure 80: Belgium GDP and Population, 2018-2019 ($)

Figure 81: Belgium GDP – Composition of 2018, By Sector of Origin

Figure 82: Belgium Export and Import Value & Volume, 2018-2019 ($)

Figure 83: Spain Coconut Sugar Market Value & Volume, 2019-2024 ($)

Figure 84: Spain GDP and Population, 2018-2019 ($)

Figure 85: Spain GDP – Composition of 2018, By Sector of Origin

Figure 86: Spain Export and Import Value & Volume, 2018-2019 ($)

Figure 87: Denmark Coconut Sugar Market Value & Volume, 2019-2024 ($)

Figure 88: Denmark GDP and Population, 2018-2019 ($)

Figure 89: Denmark GDP – Composition of 2018, By Sector of Origin

Figure 90: Denmark Export and Import Value & Volume, 2018-2019 ($)

Figure 91: APAC Coconut Sugar Market Value & Volume, 2019-2024 ($)

Figure 92: China Coconut Sugar Market Value & Volume, 2019-2024

Figure 93: China GDP and Population, 2018-2019 ($)

Figure 94: China GDP – Composition of 2018, By Sector of Origin

Figure 95: China Export and Import Value & Volume, 2018-2019 ($)Coconut Sugar Market China Export and Import Value & Volume, 2018-2019 ($)

Figure 96: Australia Coconut Sugar Market Value & Volume, 2019-2024 ($)

Figure 97: Australia GDP and Population, 2018-2019 ($)

Figure 98: Australia GDP – Composition of 2018, By Sector of Origin

Figure 99: Australia Export and Import Value & Volume, 2018-2019 ($)

Figure 100: South Korea Coconut Sugar Market Value & Volume, 2019-2024 ($)

Figure 101: South Korea GDP and Population, 2018-2019 ($)

Figure 102: South Korea GDP – Composition of 2018, By Sector of Origin

Figure 103: South Korea Export and Import Value & Volume, 2018-2019 ($)

Figure 104: India Coconut Sugar Market Value & Volume, 2019-2024 ($)

Figure 105: India GDP and Population, 2018-2019 ($)

Figure 106: India GDP – Composition of 2018, By Sector of Origin

Figure 107: India Export and Import Value & Volume, 2018-2019 ($)

Figure 108: Taiwan Coconut Sugar Market Taiwan 3D Printing Market Value & Volume, 2019-2024 ($)

Figure 109: Taiwan GDP and Population, 2018-2019 ($)

Figure 110: Taiwan GDP – Composition of 2018, By Sector of Origin

Figure 111: Taiwan Export and Import Value & Volume, 2018-2019 ($)

Figure 112: Malaysia Coconut Sugar Market Malaysia 3D Printing Market Value & Volume, 2019-2024 ($)

Figure 113: Malaysia GDP and Population, 2018-2019 ($)

Figure 114: Malaysia GDP – Composition of 2018, By Sector of Origin

Figure 115: Malaysia Export and Import Value & Volume, 2018-2019 ($)

Figure 116: Hong Kong Coconut Sugar Market Hong Kong 3D Printing Market Value & Volume, 2019-2024 ($)

Figure 117: Hong Kong GDP and Population, 2018-2019 ($)

Figure 118: Hong Kong GDP – Composition of 2018, By Sector of Origin

Figure 119: Hong Kong Export and Import Value & Volume, 2018-2019 ($)

Figure 120: Middle East & Africa Coconut Sugar Market Middle East & Africa 3D Printing Market Value & Volume, 2019-2024 ($)

Figure 121: Russia Coconut Sugar Market Russia 3D Printing Market Value & Volume, 2019-2024 ($)

Figure 122: Russia GDP and Population, 2018-2019 ($)

Figure 123: Russia GDP – Composition of 2018, By Sector of Origin

Figure 124: Russia Export and Import Value & Volume, 2018-2019 ($)

Figure 125: Israel Coconut Sugar Market Value & Volume, 2019-2024 ($)

Figure 126: Israel GDP and Population, 2018-2019 ($)

Figure 127: Israel GDP – Composition of 2018, By Sector of Origin

Figure 128: Israel Export and Import Value & Volume, 2018-2019 ($)

Figure 129: Entropy Share, By Strategies, 2018-2019* (%)Coconut Sugar Market

Figure 130: Developments, 2018-2019*Coconut Sugar Market

Figure 131: Company 1 Coconut Sugar Market Net Revenue, By Years, 2018-2019* ($)

Figure 132: Company 1 Coconut Sugar Market Net Revenue Share, By Business segments, 2018 (%)

Figure 133: Company 1 Coconut Sugar Market Net Sales Share, By Geography, 2018 (%)

Figure 134: Company 2 Coconut Sugar Market Net Revenue, By Years, 2018-2019* ($)

Figure 135: Company 2 Coconut Sugar Market Net Revenue Share, By Business segments, 2018 (%)

Figure 136: Company 2 Coconut Sugar Market Net Sales Share, By Geography, 2018 (%)

Figure 137: Company 3Coconut Sugar Market Net Revenue, By Years, 2018-2019* ($)

Figure 138: Company 3Coconut Sugar Market Net Revenue Share, By Business segments, 2018 (%)

Figure 139: Company 3Coconut Sugar Market Net Sales Share, By Geography, 2018 (%)

Figure 140: Company 4 Coconut Sugar Market Net Revenue, By Years, 2018-2019* ($)

Figure 141: Company 4 Coconut Sugar Market Net Revenue Share, By Business segments, 2018 (%)

Figure 142: Company 4 Coconut Sugar Market Net Sales Share, By Geography, 2018 (%)

Figure 143: Company 5 Coconut Sugar Market Net Revenue, By Years, 2018-2019* ($)

Figure 144: Company 5 Coconut Sugar Market Net Revenue Share, By Business segments, 2018 (%)

Figure 145: Company 5 Coconut Sugar Market Net Sales Share, By Geography, 2018 (%)

Figure 146: Company 6 Coconut Sugar Market Net Revenue, By Years, 2018-2019* ($)

Figure 147: Company 6 Coconut Sugar Market Net Revenue Share, By Business segments, 2018 (%)

Figure 148: Company 6 Coconut Sugar Market Net Sales Share, By Geography, 2018 (%)

Figure 149: Company 7 Coconut Sugar Market Net Revenue, By Years, 2018-2019* ($)

Figure 150: Company 7 Coconut Sugar Market Net Revenue Share, By Business segments, 2018 (%)

Figure 151: Company 7 Coconut Sugar Market Net Sales Share, By Geography, 2018 (%)

Figure 152: Company 8 Coconut Sugar Market Net Revenue, By Years, 2018-2019* ($)

Figure 153: Company 8 Coconut Sugar Market Net Revenue Share, By Business segments, 2018 (%)

Figure 154: Company 8 Coconut Sugar Market Net Sales Share, By Geography, 2018 (%)

Figure 155: Company 9 Coconut Sugar Market Net Revenue, By Years, 2018-2019* ($)

Figure 156: Company 9 Coconut Sugar Market Net Revenue Share, By Business segments, 2018 (%)

Figure 157: Company 9 Coconut Sugar Market Net Sales Share, By Geography, 2018 (%)

Figure 158: Company 10 Coconut Sugar Market Net Revenue, By Years, 2018-2019* ($)

Figure 159: Company 10 Coconut Sugar Market Net Revenue Share, By Business segments, 2018 (%)

Figure 160: Company 10 Coconut Sugar Market Net Sales Share, By Geography, 2018 (%)

Figure 161: Company 11 Coconut Sugar Market Net Revenue, By Years, 2018-2019* ($)

Figure 162: Company 11 Coconut Sugar Market Net Revenue Share, By Business segments, 2018 (%)

Figure 163: Company 11 Coconut Sugar Market Net Sales Share, By Geography, 2018 (%)

Figure 164: Company 12 Coconut Sugar Market Net Revenue, By Years, 2018-2019* ($)

Figure 165: Company 12 Coconut Sugar Market Net Revenue Share, By Business segments, 2018 (%)

Figure 166: Company 12 Coconut Sugar Market Net Sales Share, By Geography, 2018 (%)

Figure 167: Company 13Coconut Sugar Market Net Revenue, By Years, 2018-2019* ($)

Figure 168: Company 13Coconut Sugar Market Net Revenue Share, By Business segments, 2018 (%)

Figure 169: Company 13Coconut Sugar Market Net Sales Share, By Geography, 2018 (%)

Figure 170: Company 14 Coconut Sugar Market Net Revenue, By Years, 2018-2019* ($)

Figure 171: Company 14 Coconut Sugar Market Net Revenue Share, By Business segments, 2018 (%)

Figure 172: Company 14 Coconut Sugar Market Net Sales Share, By Geography, 2018 (%)

Figure 173: Company 15 Coconut Sugar Market Net Revenue, By Years, 2018-2019* ($)

Figure 174: Company 15 Coconut Sugar Market Net Revenue Share, By Business segments, 2018 (%)

Figure 175: Company 15 Coconut Sugar Market Net Sales Share, By Geography, 2018 (%)

Email

Email Print

Print